03 August 2022

Ad hoc announcement pursuant to art. 53 listing rules: GAM Holding AG announces first half 2022 results

Financial highlights

- Total assets under management (AuM) were CHF 83.2 billion as at 30 June 2022, with Investment Management at CHF 27.1 billion and Fund Management Services at CHF 56.1 billion, compared to a total of CHF 99.9 billion as at 31 December 2021.

- Negative market movements of CHF 12.4 billion and foreign exchange of CHF 0.7 billion accounted for almost 80% of the reduction in assets under management.

- Investment management saw an improving trajectory for flows, despite the challenging market conditions, with net client outflows of CHF 1.1 billion in the first half of 2022.

- Fund Management Services saw a net outflow of CHF 2.5 billion, most of which relates to a client transferring their business to another provider as a part of a broader strategic relationship with that provider which was announced in January 2021.

- Underlying loss before tax was CHF 15.4 million compared to an underlying CHF 0.8 million profit for the first half of 2021.

- The reduction in AuM has led to a non-cash impairment charge of CHF 263.6 million, related to the intangible brand value, (remaining value CHF 9.4 million), which was created by the acquisition of GAM by Julius Baer in 2005.

- IFRS net loss of CHF 275.2 million compared to the IFRS net loss after tax of CHF 2.7 million for the half year 2021.

- The impairment charge and IFRS loss do not impact the Group’s tangible equity, its cash position or any client related or operational functions.

Strategic highlights

- Good investment performance: 73% of investment management assets under management outperformed their benchmark over three years.

- Strong client engagement: thought leadership driving interest in our differentiated strategies.

- Helping clients meet their needs with diverse, active strategies.

- Resilience of flows: clients allocating to a number of our high conviction strategies.

- Continuing to attract high calibre talent.

- Capitalising on our new, cloud-based operating platform: delivering excellence and further efficiencies.

- Acceleration of efficiency programme, resulting in total expenses expected to be approximately CHF 20 million lower for the full year 2022 compared to full year 2021.

- A further reduction in total expenses of at least CHF 20 million is expected in full year 2023.

- Drive capital efficiency across legal entities and businesses.

- 2024 financial targets are now more challenging, and these will be revisited at the end of 2022 given the current volatile market environment.

Peter Sanderson, CEO GAM Investments said: “GAM’s business performance was resilient in the face of the extraordinary economic and geopolitical conditions during the first half of 2022. Despite clients being cautious in the face of market volatility, we are encouraged to see them allocating to a number of our diverse, high conviction active strategies. We continue to take action to reduce our costs given the decrease in our revenues. We are confident that our approach to active management is well placed to assist our clients in the current market environment.”

Investment management

- Assets under management totalled CHF 27.1 billion as at 30 June 2022, compared with CHF 31.9 billion as at 31 December 2021.

- Almost 80% of the CHF 4.8 billion AuM reduction was driven by negative market movement and foreign exchange of CHF 3.7 billion; net outflows were CHF 1.1 billion.

- Clients are allocating to a number of our high conviction strategies designed to help them navigate this challenging environment.

- Amongst those strategies seeing net inflows during the first half were the CAT Bonds, UK Equity Income, Mortgage-backed Securities, and Commodities funds.

Fund Management Services

- AuM as at 30 June 2022 totalled CHF 56.1 billion, compared with CHF 68 billion as at 31 December 2021.

- Net outflows of CHF 2.5 billion were mostly the final tranche of a previously announced outflow. Approximately 80% of the AuM reduction was due to negative market movements (CHF 8.7 billion) and foreign exchange (CHF 0.6 billion).

Good investment performance

- Over the three-year period to 30 June 2022, 73% of AuM in funds outperformed their respective benchmark, compared with 68% as at 31 December 2021.

- Over the five-year period to 30 June 2022, 40% of AuM in funds outperformed their respective benchmark, compared with 60% as at 31 December 2021.

- Of GAM’s AuM tracked by Morningstar, 69% and 58% outperformed their respective peer groups over the three- and five-year periods to 30 June 2022, respectively, compared with 70% and 62% as at 31 December 2021.

Strong client engagement

- Significant increase in client meetings since the beginning of the year, many of which being led by our portfolio managers and investment specialists.

- Clients are particularly focused on our specialist fixed income, alternative strategies and certain equity strategies.

- This interest is reflected in both the strategies seeing positive flows during the first half of the year and a building pipeline of potential future flows.

Technology platform upgrade almost complete

- Key to simplifying our business and driving further efficiencies is our new cloud-based operating platform which is largely complete.

- We are now seeing the benefits in the way we run the business and expect to see further improvements in efficiency.

H1 2022 total expenses 9% lower than H1 2021: further efficiencies to come

- Total expenses of CHF 109.5 million, down from CHF 120.6 million in the first half of 2021.

- We expect total expenses for the full year 2022 to be approximately CHF 20 million lower than the full year 2021.

- In addition, we expect a further reduction in total expenses of at least CHF 20m for the full year 2023. Cost reductions will be delivered primarily through an acceleration of our efficiency plans.

- Variable compensation will continue to reflect our revenues.

- We will continue to simplify the business and legal structures to ensure efficient capital structures.

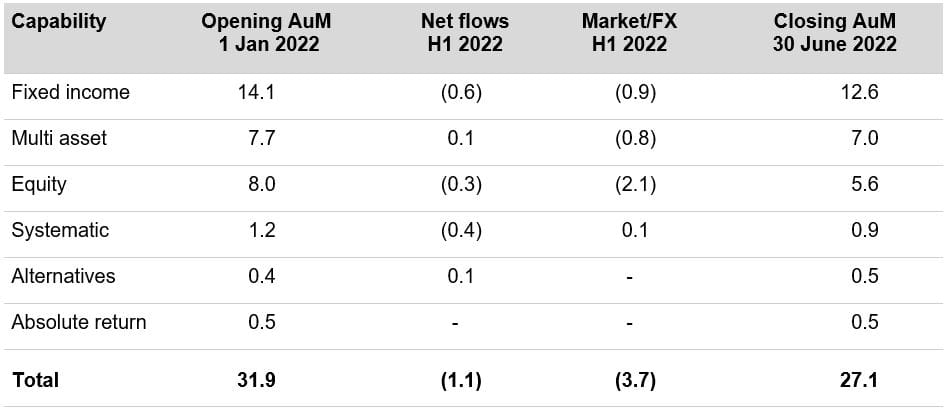

Assets under management movements (CHF bn)

Net flows by capability

Our fixed income strategies saw net client outflows of CHF 0.6 billion. The majority of these were from the GAM Star Credit Opportunities and GAM Local Emerging Bond funds. However, we saw strong net inflows into our CAT bond strategies which now amount to CHF 4.7 billion of AuM. This reflects client demand for our high conviction strategies designed to help them navigate this challenging environment. Other fixed income strategies attracting client interest and net flows include Mortgage-Backed Securities.

In equities, net ouflows amounted to CHF 0.3 billion and were mainly driven by the GAM Star Disruptive Growth, GAM Star Continental European Equity, GAM Japan Equity, and GAM Star Japan Leaders funds. These outflows were partially offset by inflows into the GAM UK Equity Income fund, GAM Emerging Markets Equity and GAM Swiss Equity funds.

Our multi asset strategies saw inflows of CHF 0.1 billion

Alternatives recorded net inflows of CHF 0.1 billion, primarily reflecting inflows into from the GAM Commodity fund, again reflecting client demand for our high conviction strategies.

Systematic saw net outflows of CHF 0.4 billion. This was mainly driven by an institutional client allocating away from the GAM Systematic Alternative Risk Premia strategy.

Absolute return flows remained flat.

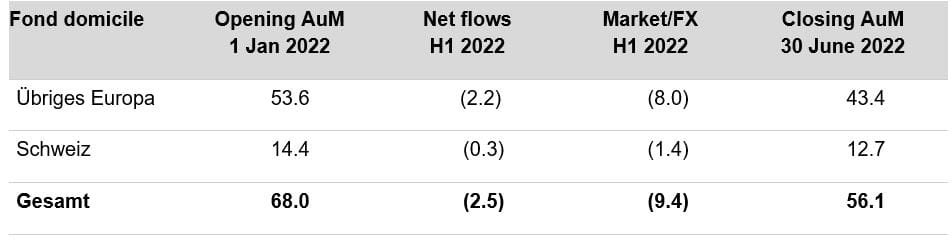

Assets under management movements (CHF bn)

As at 30 June 2022, AuM in Fund Management Services decreased to CHF 56.1 billion compared to CHF 68.0 billion at the end of FY 2021. The drivers were net negative market and foreign exchange movements of CHF 9.4 billion and net outflows of CHF 2.5 billion which mostly related to the final tranche of a large client moving to another provider which was announced in January 2021.

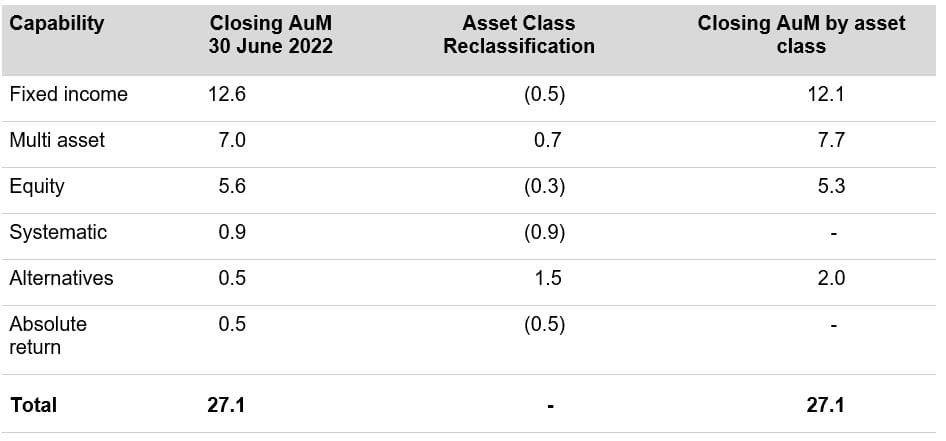

Changes to investment capability reporting

We are changing how we report our Investment Management and Fund Management Services assets under management and net flows to reflect how our clients engage with our strategies and how we manage the business. The current six capabilities in Investment Management will be reduced to four, with some fixed income and equities strategies moving to multi asset and our systematic and absolute return strategies will be combined under alternatives.

The table below shows the impact of this change in reporting on our Investment Management AuM as at 30 June 2022. All future reporting of assets under management, net flows, investment performance and fee margins will be based on the four capabilities.

Underlying net fee and commission income was CHF 93.5 million compared to CHF 127.3 million in H1 2021. This reduction was primarily driven by reduced performance fees from CHF 17.3 million in H1 2021 to CHF 2.6 million in H1 2022. The H1 2022 performance fees were mainly generated by GAM Systematic. The H1 2021 performance fees were mainly driven by of GAM Star Disruptive Growth which was impacted by the market environment in the first half of 2022. IFRS net fee and commission income amount to CHF 94 million. The difference between the underlying and the IFRS net fee and commission income of CHF 0.5 million relates to performance fees attributed to external interests.1

Underlying personnel expenses decreased to CHF 62.1 million in H1 2022 from CHF 77.9 million in H1 2021. This was driven by lower headcount which was 594 full time equivalents as at 30 June 2022 down from 652 as at 30 June 2021. The difference between the underlying and IFRS personnel expenses of CHF 1.7 million mainly relates to a reorganisation charge of CHF 1.7 million.

Underlying general expenses totalled CHF 37.9 million in H1 2022 compared to CHF 33.9 million in H1 2021. This was mostly driven by some one-off professional and consulting fees and an increase in marketing and travel expenses given the lesser impact of Covid-19. The difference between the underlying and IFRS general expenses of CHF 0.2 million mainly relates to non-recurring professional and consulting services.

The underlying operating margin stood at negative 17.1% compared with a positive 3.6% in H1 2021, mostly as a result of reduced performance fees which were only partially offset by the 9% reduction in total expenses. The difference between the underlying and IFRS operating margin mainly relates to a non-cash impairment of legacy brand value (CHF 263.6 million).

The underlying pre-tax loss was CHF 15.4 million compared to an CHF 0.8 million underlying pre-tax profit for H1 2021. This was also as a result of reduced performance fees which were only partially offset by the 9% reduction in total expenses. The difference between the underlying and IFRS loss of CHF 260.5 million mainly relates to a non-cash impairment of legacy brand value (CHF 263.6 million).

There was an underlying tax credit for H1 2022 of CHF 1.4 million, compared with a tax expense of CHF 3.1 million in H1 2021. The difference between the underlying and IFRS tax expenses of CHF 0.7 million mainly relates to the tax impact from net foreign exchange gains on the pension loan note.

Diluted underlying losses per share were CHF 0.09, compared to a loss of CHF 0.01 in H1 2021. The difference between the underlying loss of CHF 0.09, and the IFRS loss per share of CHF 1.76, mainly relates to the higher IFRS net loss of CHF 275.2 million compared to an underlying net loss of CHF 14.0 million.

The IFRS net loss was CHF 275.2 million in H1 2022 compared with a net loss of CHF 2.7 million in H1 2021. The loss in H1 2022 was mainly driven by the impairment of legacy brand value (CHF 263.6 million), which was created by the acquisition of GAM by Julius Baer in 2005.

Cash and cash equivalents as at 30 June 2022 were CHF 171.7 million compared to CHF 234.8 million as at 31 December 2021. This reduction was driven by the underlying loss, annual bonus payments relating to 2021, the payment of the FCA fine, further investments in our operating platform, pension deficit repair payments and the net impact of foreign exchange movements.

Adjusted tangible equity as at 30 June 2022 was CHF 164.4 million, compared with CHF 174.2 million as 30 December 2021.

We expect the markets to remain volatile and clients to remain cautious. However, we expect clients to continue to allocate to our diverse, high conviction strategies designed to help them navigate the risks and opportunities during this challenging period. We are confident that our approach to active management is well placed to assist our clients in the current market environment.

The presentation of the H1 2022 results of GAM Holding AG analyst, investors and media will take place on Webex on 3 August 2022 at 10.00 (CET). Materials relating to the results (presentation slides, 2022 Half Year Report and press release) are available at www.gam.com.

| 20 October 2022 | Q3 2022 Interim management statement |

| 28 February 2023 | Full year results 2022 |

| Charles Naylor Head of Communications and Investor Relations T +44 7890 386 699 |

|

| Investor Relations Stephen Gardner T +44 7790 778544 |

Media Relations Ute Dehn Christen T+41 58 426 31 36 |

Visit us at: www.gam.com

About GAM

We are an active, independent global asset manager that thinks beyond the obvious to deliver distinctive and differentiated investment solutions for our clients across our three core businesses: Investment Management, Wealth Management and Fund Management Services.

Our purpose is to protect and enhance our clients’ financial future. We attract and empower the brightest minds to provide investment leadership, innovation and a positive impact on society and the environment.

Servicing institutions, financial intermediaries, and private investors, we manage CHF 83.2 billion of assets.

Headquartered in Zurich, GAM Investments is listed on the SIX Swiss Exchange with the symbol ‘GAM’ and we employ 594 people across 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York and Milan, as at 30 June 2022. Our operational centres are in Dublin, Luxembourg and London.

Disclaimer regarding forward-looking statements

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities, and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include but are not limited to changing business or other market conditions, legislative, fiscal, and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance, or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions, or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.