Artificial intelligence (AI) and machine learning (ML) are among the most transformational emerging technologies and we are in the foothills of seeing these being applied to lending. GAM Investments’ Kevin Kruczynski explains why he thinks this could be positive for both borrowers and the banks.

20 May 2022

Click here to view the Disruptive Strategist newsletter in full.

A generation ago, obtaining a loan was a privilege granted to someone who needed to be on personal terms with the local bank manager, who would be well placed to assess an individual’s character and financial circumstances before deciding whether to make a loan. Over the years that level of relationship banking has faded, bank branch networks have receded, while credit has become more ubiquitous, and available to more people than ever. A large part of this transformation has been facilitated by credit reference agencies that use established models to monitor an individual’s credit activities to assess their creditworthiness. Typically, a higher credit score will unlock a wider and cheaper array of credit options.

Looking at the US, FICO launched its credit scoring algorithm in 1989, which uses five variables to calculate an individual’s credit score. Banks then set minimum score thresholds to qualify for prime lending products. This is a well-established system that is entrenched in most lending departments, and until recently there has been little incentive to move on and adopt newer technologies. The major flaw is that perfectly good loan applicants are falling below the threshold, due to the rigidity and biases in the system. It is estimated that 80% of Americans have never defaulted on a credit product, yet only 49% have access to prime lending through the current system.1 The result is that many borrowers who have the will and means to repay are rejected by the prime system, forcing them to pursue higher priced subprime lending options, while significant revenues and growth prospects are being left on the table by the banks.

Newer AI and ML driven credit scoring approaches are emerging that can more accurately assess an individual’s creditworthiness. The latest AI driven models look at over 1500 data points, including data mined from digital footprints and social media. These newer techniques also use more streamlined and up-to-date cloud-based infrastructure that is much easier and cheaper to maintain than legacy systems in place at most banks, making it easier to meet regulatory requirements, and help detect fraud. Analysis by McKinsey2 shows how banks that have embraced newer lending models, have increased revenues by up to 15% and lowered default rates by up to 40%, achieved through a combination of better customer experience, higher acceptance rates, lower customer acquisition costs and default rates. On top of this, there is the side benefit of more streamlined workflows and processes.

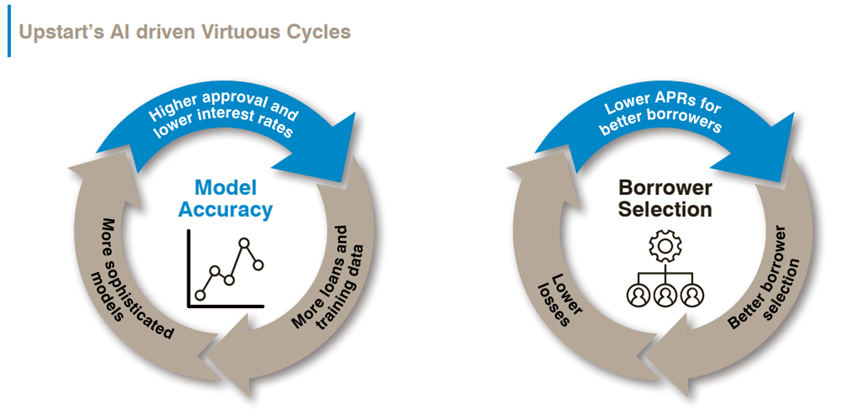

The US alone has more than 4000 banks. We believe very few have the scale to develop systems using the latest proprietary technology, and even fewer have the allure to attract the top talent from Silicon Valley. There are some interesting business models emerging. Of these, Upstart appears to be emerging as a key enabler in this field as its platform-based approach starts to reach a critical mass. The company was formed 10 years ago by former Google employees effectively seeking to disrupt the credit decision making process, based on the premise of applying modern data science and the latest technology to improve outcomes. The number of variables on their algorithms is now over 1500 and growing. This helps feed a virtuous cycle as the more credit issued using Upstart, the more accurate the algorithm becomes, and results so far have been positive, with more borrowers approved and lower loss rates. Rather than keep the loans on their books and take on credit risk, they work with banks who wish to originate credit using their technology. Currently they have 30 banks on the platform and hope to expand this to over 100 within a year or so. Clearly the growth runway remains long, as the more loans approved using their technology, the more evidence of positive outcomes is generated and the more confidence banks will have to embrace it.

2Source: Designing next-generation credit-decisioning models, McKinsey & Company, 2 December 2021.

GAM is an independent, global provider of asset management services operating in three principal fields: investment management, wealth management and third-party fund management services. Across all areas of our business we are committed to the pursuit of highly differentiated strategies, having long recognised that results beyond the ordinary are best achieved by thinking beyond the obvious.

Important legal informationThe information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. There is no guarantee that forecasts will be achieved. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Assets and allocations are subject to change. Past performance is no indicator for the current or future development.