Buffeted by various headwinds in recent years and now plunged into further uncertainty by Covid lockdowns, China has been largely shunned by investors of late. However, with government stimulus beginning to emerge and plenty of tools left in the toolbox GAM Investments’ Tim Love considers whether China currently offers value for investors.

12 May 2022

The emerging market (EM) universe has faced consistent and significant headwinds since Q1 2021 impacted by movements in China, culminating recently in a collective broader and multifaceted EM equity sell off across value stocks, GARP stocks and non-correlated stocks.

A contributing factor to the sell-off within value stocks is China’s zero-Covid lockdown policy causing a demand shock to an already fragile global economy. China has seen 26 million Shanghai residents in a severe lockdown for more than five weeks sparking fears over further supply constraints and economic damage. The government’s zero-Covid policy has also eroded trust in China’s A-shares, which normally beat to a different drum to H-shares. Meanwhile, GARP plays have and continue to be impacted by regulatory arbitrage between the US and China regarding China ADRs.

Despite China’s zero-Covid policy, combined with the global impact of the Ukraine-Russia conflict, sparking growth fears, EM equity has delivered outperformance versus the MSCI All Country World Index year-to-date. Whether this outperformance will be absolute as well as relative depends on whether a growth slowdown or an actual recession emerges.

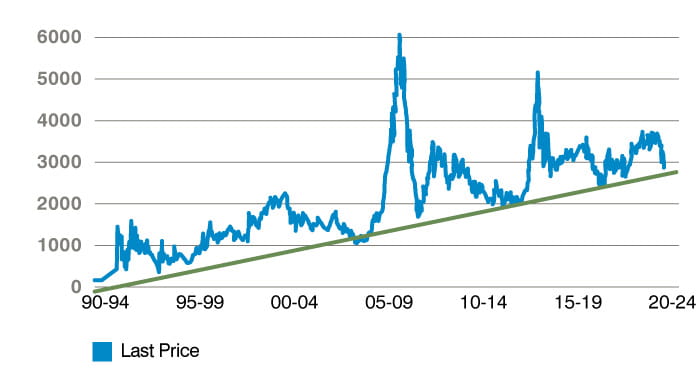

The Hang Seng Index was trading on 0.7 times historic price-to-book as of 6 May 2022. This is within 10% of where markets have historically bottomed. Similarly, when looking at the forward price-to-earnings ratio, JP Morgan’s China Equity Strategist notes the MSCI China index is currently in the bottom decile of its history since 2016.

Chart 1: Shanghai Composite (price index)

A watershed moment for government stimulus in China?

Given the size of China within emerging markets, a meaningful stimulus programme, with an element of an infrastructure multiplier effect, would be very well received by the market in our view. To date, stimulus has been long awaited and underwhelming in China. However, we are starting to see some tangible monetary and fiscal supports emerging, with bank reserve requirement ratio (RRR) cuts and supportive credit measures with regards to the finance and property sectors. A small boost to China aggregate financing stock has helped property stocks find a base, following large sell offs. We believe the China property sector may be turning a corner. National property sales in March were down 26%, while property sales value and volume in Q1 were down 22.7% year-on-year and 13.8% year-on-year, respectively. In addition, growth in real estate investment slowed further as developers remained cautious on operational outlook: real estate investment was up by only 0.7% year-on-year in Q1 2022, marking the slowest year-to-date growth rate since H2 2020. Loosening policies are now in motion including the RRR cut, the improvement in terms of cash collection, the cut in mortgage rates and the relaxation on home purchase restrictions.

China beyond Covid

Thus far, China’s growth has been one sided and overly dependent on exports/infrastructure-related capex, even as retail sales and the property market are languishing. The risk is that with the global export outlook softening amid rising risks to global growth and the People’s Bank of China’s aggressive easing finally starting (as the Federal Reserve tightens), this could spill over to the Chinese yuan (CNY) once the trade surplus narrows, as we saw occur in 2018.

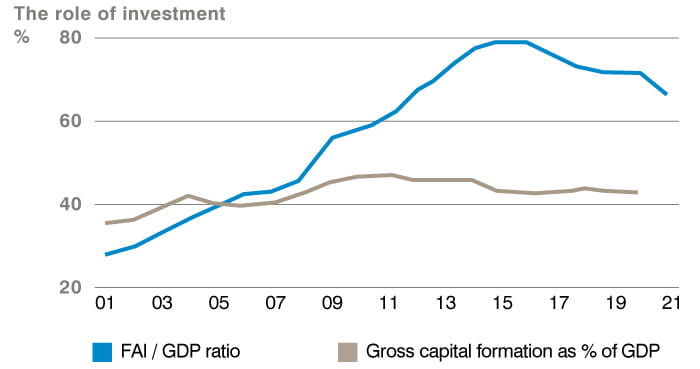

As China pivots away from its current zero-Covid stance, we expect it to focus its post-Covid stimulus on areas with a structural multiplier effect on GDP, with a focus on productivity gains, prosperity for all and the levelling up of rural areas via reforms (including pension and rural land ownership). It will also likely move from fixed asset investment (FAI) to more consumption and clean energy orientated investment, in our view.

Chart 2:

In the first quarter of 2022, China’s GDP growth of 4.8% year-on-year outperformed the consensus reading of 4.4% year-on-year. Correspondingly for March, every major indicator, except for retail sales, also exceeded consensus (FAI year-to-date: 9.3% year-on-year [consensus: 8.5%], industrial production (IP) in March: 5% year-on-year [consensus: 4.5%], and GDP quarter-on-quarter: 1.3% [consensus: 0.6%]). The key exception was March’s retail sales growth reading of -3.5% year-on-year versus consensus of -1.6%. However, the above consensus readings alone do not necessarily mean it is time to be more optimistic.

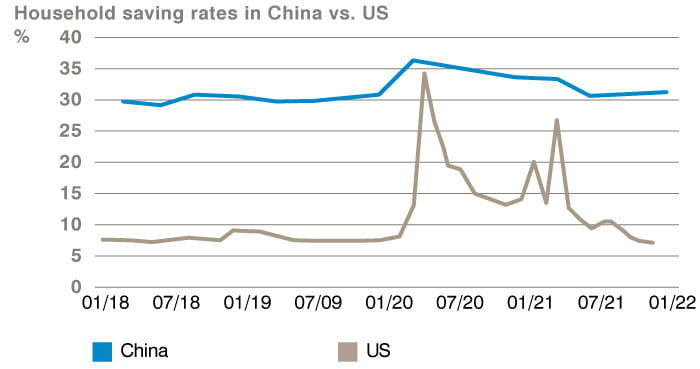

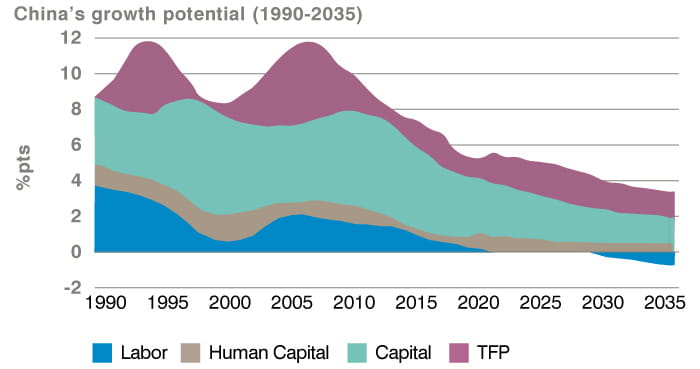

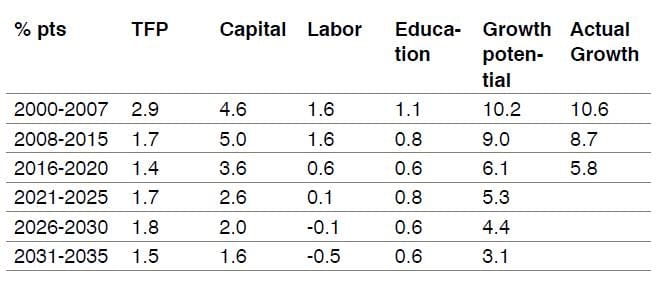

China’s households, whose savings underpinned the investment-boom, need to start spending more and saving less. It is therefore crucial that China drives policies to lower its household savings ratio (which is currently at more than 30%), and as you can see from the chart below is much higher than US household levels (5-10%). China’s economy remains skewed to investment, with investment accounting for more than 40% of GDP. We would expect a shift to more consumer-focused sectors with large ticket consumer durables at the front. China’s growth over the past 30 years has been driven mostly by capital, with labour and productivity secondary. But going forward, given China’s stock of FAI is now very high and China’s labour force is now shrinking, the focus has to be on total factor productivity (TFP). We expect to see a shift from quantum of capital to quality of capital.

Chart 3:

Chart 4

Chart 5

The potential for ‘big bang’ policies

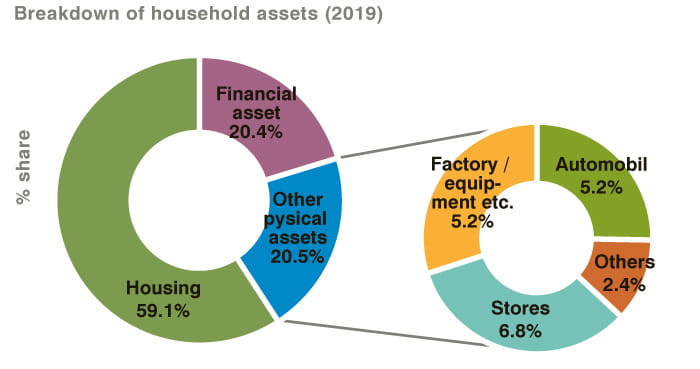

Other factors in China’s growth story are potential “big bang” pension and/or rural land reforms. Bloomberg headlines that China is pushing “personal pension developments” reminds us China still has “big bang” reforms to potentially implement. The Bloomberg headlines follow on from an opinion piece on a government website outlining the case for individuals being able to invest up to RMB 12 000 per year in financial instruments as part of a personal pension. As you can see from the chart below, financial assets currently make-up just 20% of household assets (versus more than 60% in the US). Expanded pension nets are also crucial to driving consumption growth (point 1), and also the broader health of the market (long-term capital inflows).

Chart 6:

Beyond pensions, another area to watch for is rural land/property reform. Recall China’s privatisation of the urban housing market in the 1990s drove an ownership culture that underpinned GDP growth. Rural property is currently not individually owned, so reforms which create improved rural land use rights could help drive improved rural household asset ownership and wealth accumulation.

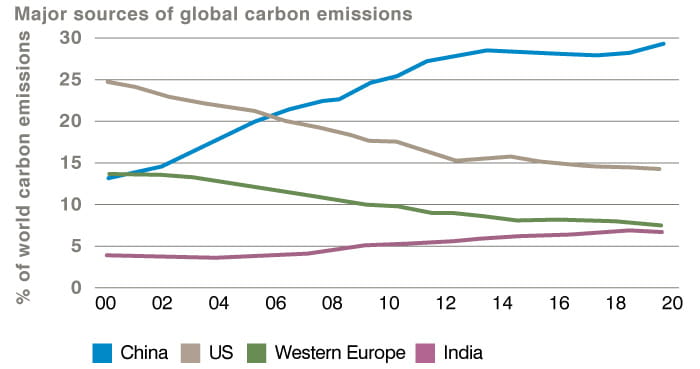

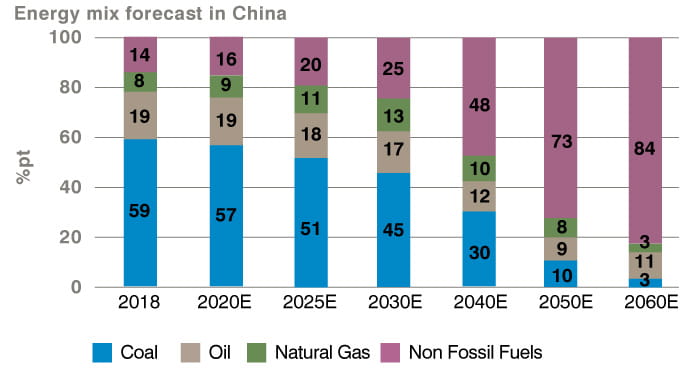

China’s energy mix remains heavily skewed to coal (55%) and oil (18%), with renewables at just high teens. Yet China remains focused on transitioning towards more clean energy - both for pollution and energy security reasons. China is now the biggest electric vehicle (EV) market globally (we forecast more than 5 million NEVs will be sold in China in 2022) and is ahead of all other countries on capacity for renewable energy. To put things in perspective, We believe China is likely to add more wind capacity this year (28GW) than the entirety of the UK’s wind power capacity (25GW).

Chart 7:

Chart 8

Asset allocators currently have a low allocation to China, but the above factors lead us to believe that going underweight in China is as dangerous as going neutral/overweight. In our view, the sell-off in risk assets has been too indiscriminate and valuation support remains strong. We believe today’s environment may offer the contrarian value investor an entry point for attractive opportunities. As such, we are exploring China weakness in selective non-regulatory controversial quality names and investing alongside the five-year programmes where possible.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. There is no guarantee that forecasts will be achieved. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Assets and allocations are subject to change. Past performance is no indicator for the current or future development.