Wednesday, October 18, 2017

GAM Holding AG: Interim management statement for the three-month period to 30 September 2017

- Group assets under management up 13% to CHF 148.4 billion from 30 June 2017 and up 23% in the first nine months of 2017

- Total net inflows of CHF 11.8 billion

- Investment management:

- Assets under management of CHF 78.7 billion, up 9% from 30 June 2017, driven by strong net inflows, positive investment performance and foreign exchange movements

- Net inflows of CHF 3.5 billion, with, in particular, strong flows into fixed income strategies

- Private labelling:

- Assets under management of CHF 69.7 billion, up 18% from 30 June 2017, driven by strong net inflows

- Net inflows of CHF 8.3 billion

- GAM to absorb all research costs following the implementation of MiFID II in January 2018

- Multi-year change programme to deliver significant operating efficiencies progressing well

Group CEO Alexander S. Friedman said: “I am pleased with our continued momentum in the third quarter: the investment performance for the vast majority of our funds was strong, our net inflows were very good, and we remain on track with our strategic initiatives. We continue to see healthy client interest for our products, although we do not expect the pace of third-quarter inflows to be consistently maintained. Our focus remains on providing excellent investment performance in differentiated strategies that meet our clients’ needs, disciplined execution of our growth strategy and ensuring we make GAM as efficient as possible.”

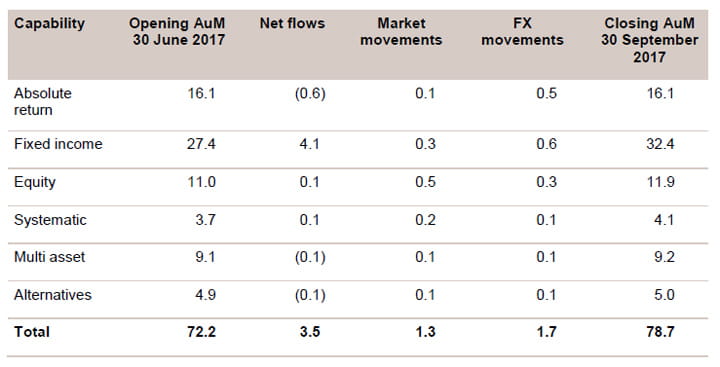

Assets under management increased to CHF 78.7 billion from CHF 72.2 billion as at 30 June 2017, driven by strong net inflows, positive investment performance and foreign exchange movements.

Assets under management movements (CHF bn)

Investment performance continued to improve, with 75% of investment management assets in funds outperforming their respective benchmark over the three-year period to 30 September 2017 (71% as at 30 June 2017). Over the five-year period, 72% of assets in funds were outperforming (72% as at 30 June 2017).

Absolute return strategies had net outflows of CHF 0.6 billion as inflows into the GAM Star Global Rates and the GAM Star (Lux) – Merger Arbitrage were offset by outflows from the unconstrained/absolute return bond strategy, although this strategy has a strong pipeline.

In fixed income, net inflows totalled CHF 4.1 billion. The GAM Star Credit Opportunities strategy, which predominantly invests in debt of investment grade or high quality issuers, attracted strong inflows. The GAM Local Emerging Bond fund, which invests in debt of emerging countries denominated or pegged to the respective local currency and the GAM Star MBS Total Return fund, also recorded good inflows.

In equity, net inflows totalled CHF 0.1 billion, driven by inflows into the GAM Star Continental European Equity fund, partly offset by redemptions from the GAM UK Diversified, GAM Japan Equity and GAM Star China Equity funds.

Systematic strategies saw net inflows of CHF 0.1 billion, driven by inflows into the GAM Systematic Alternative Risk Premia fund and related mandates.

Multi asset strategies experienced net outflows of CHF 0.1 billion, reflecting redemptions in the private client advisory business.

Net outflows of CHF 0.1 billion in alternatives largely reflected redemptions in the fund of hedge funds business.

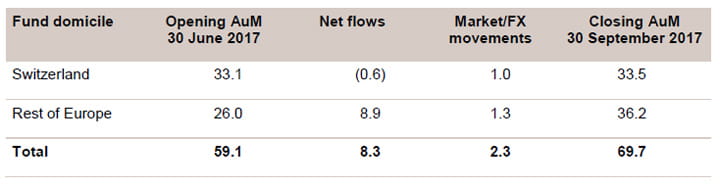

Assets under management movements (CHF bn)

Assets under management in private labelling, which provides fund solutions for third parties, rose to CHF 69.7 billion from CHF 59.1 billion as at 30 June 2017, driven by net inflows of CHF 8.3 billion. The majority of inflows came from an existing client with a below average management fee margin.

In September GAM hired Adrian Gosden, a highly regarded UK investor, as investment director. A new UK equity income fund will be launched later this year. GAM also continued to strengthen its distribution capabilities with the hire of Shizu Kishimoto to lead its sales and overall business operations in Japan.

The Group’s multi-year change programme to deliver significant operating efficiencies is progressing well, with the new single data architecture provider selected and implementation underway.

GAM has decided to absorb all research costs from January 2018, following the implementation of the new Markets in Financial Instruments Directive (MiFID II). This underlines GAM’s commitment to placing clients’ interests first, while ensuring sustainable growth for all stakeholders. GAM currently expects research costs to amount to mid-single-digit CHF millions per annum.

Strong investment performance across the vast majority of GAM’s product range and the strengthening of distribution capabilities should continue to help support future net inflows. The Group’s key priorities remain delivering operating efficiencies and achieving its targets over the business cycle.

The Board of Directors is making good progress on its comprehensive review of the Group’s compensation policies and structures and expects to update the market prior to the release of 2017 full-year results.

1 March 2018 Full-year results 2017

19 April 2018 Interim management statement Q1 2018

26 April 2018 Annual General Meeting

Media Relations:

Elena Logutenkova

+41 (0) 58 426 63 41

Investor Relations:

Patrick Zuppiger

+41 (0) 58 426 31 36

Follow us on: Twitter and LinkedIn

GAM is one of the world’s leading independent, pure-play asset managers. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employs over 900 people in 13 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano. The investment managers are supported by an extensive global distribution network.

Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange and is a component of the Swiss Market Index Mid (SMIM) with the symbol ‘GAM’. The Group has assets under management of CHF 148.4 billion (USD 153.3 billion) as at 30 September 2017.

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.