18 February 2021

GAM Holding AG announces full-year 2020 results

Highlights

- Q4 2020: first quarter of positive net inflows in Investment Management since 2018

- Overall investment performance recovering: strong investment performance in equity strategies

- Underlying loss before tax of CHF 14.9 million compared to underlying profit of CHF 10.5 million in 2019 – IFRS net loss of CHF 388.4 million

- Exceeded cost reduction target with CHF 71.6 million of savings versus 2019

- Financial targets remain unchanged, now expected to be achieved in FY 2024

- Operations resilient with high productivity in remote working environment

- Commitment to growth underscored by new distribution leadership and strengthened investment specialist team

- New head of sustainable investment: sustainability as a strategic priority

- Group assets under management of CHF 122.0 billion as at 31 December 2020 down from CHF 132.7 billion1 as at 31 December 2019

Investment management – positive flows in fourth quarter

- Assets under management (AuM) totalled CHF 35.9 billion as at 31 December 2020, compared with CHF 48.4 billion1 as at the end of 2019

- Net outflows of CHF 10.6 billion, impact from the sale of funds of CHF 0.9 billion and net negative foreign exchange movements of CHF 1.9 billion were only partly offset by net positive market movements of CHF 0.9 billion in full year 2020

- The fourth quarter of 2020 delivered net inflows of CHF 0.3 billion, the first quarter of positive net inflows since the beginning of 2018

AuM in Private Labelling of CHF 86.1 billion as at 31 December 2020, up from CHF 84.3 billion at the end of 2019

Investment outperformance: 70% of investment management AuM outperformed their benchmark over five years, and 23% over three years (down from 78% and 74% in 2019, respectively)

Accelerated efficiency programme exceeded cost savings target

- Total expenses reduced by CHF 71.6 million compared to 2019

- Further simplification of the business with additional efficiency gains of CHF 15 million in fixed staff costs and general expenses in FY 2021

- Jeremy Roberts joined GAM on 1 September as global head of distribution and Jill Barber joined GAM on 2 November as global head of institutional solutions

- New dual-leadership structure facilitates enhanced focus on specific client segments

- Rob Bailey joined as head of UK distribution on 12 October to focus on growth of the UK wholesale business

- Strengthened and augmented investment specialist team in 2020 to drive growth with the appointment of Matt Williams, Paras Bakrania and Davide Petrachi to lead product specialist efforts for equities, systematic and multi-asset, respectively, together with Ralph Gasser for fixed income

New distribution leadership with a focus on growth

Strategic focus on sustainable investment to meet client demand

- Stephanie Maier joined GAM as head of sustainable and impact investment on 4 January 2021 to lead sustainable investment and ESG as a strategic priority

- Launched sustainable local emerging bond strategy in January 2021, with strong pipeline of other new product launches to complement our existing offering

- Aspiration to establish GAM as a leader on corporate sustainability, including strengthening our policies and disclosure as we continue to explore becoming a certified B Corporation

- First Sustainability Report published to further enhance the transparency of the firm while continuing to show commitment towards the progression of our corporate sustainability strategy

Technology upgrade: SimCorp implementation progressing

- Fully integrated front-to-back investment platform will enable all investment teams to operate on a single platform, enhance client experience, increase transparency and operating effectiveness as well as generate efficiencies

- Equity capabilities being successfully migrated, with remaining capabilities to transition in 2021

Financial targets unchanged, but timing now FY 2024 due to impact of the pandemic

- Underlying pre-tax profit of CHF 100 million

- Operating margin of 30%

- Compensation ratio of 45-50%

Group Management Board (GMB) will receive no bonus award for 2020

- Portfolio managers’ contractual compensation arrangements remain unchanged

- Other firm-wide variable compensation reflects the financial performance of the firm

- Any bonus awards granted under the annual discretionary bonus plan for non-GMB employees will be fully deferred over a period of three years

Board of Directors (BoD) will propose no dividend for the financial year 2020, in line with dividend policy

Board of Directors to permanently waive a portion of its fees in recognition of the market environment

Peter Sanderson, Group CEO, said: “GAM has continued to make strong progress on our strategy focused on efficiency, transparency and growth, even in the very challenging conditions of 2020. As a team we were confident in our strategy as demonstrated by the steps we took in March to accelerate our efforts to future-proof the firm. I am pleased to see our strategy begin to bear fruit with positive momentum in our investment management business during the fourth quarter.

GAM continues to attract and retain some of the brightest minds in the industry; we made some important appointments in 2020 and, along with the existing team, we all share the same belief and focus to grow the business as we provide clients with the investment leadership, innovation and sustainable thinking needed to protect their financial future.”

Net fee and commission income decreased by 29% to CHF 233.2 million compared with CHF 329.9 million in 2019. This was primarily driven by lower net management fees and commissions as a result of the lower average AuM and lower management fee margin in investment management, only partly offset by higher average AuM and higher management fee margins in private labelling. Net performance fees decreased to CHF 2.8 million from CHF 12.8 million, main contributors were non-directional equity and fixed income strategies.

Personnel expenses decreased by 24% to CHF 150.5 million in 2020 from CHF 197.0 million in 2019. Variable compensation was 44% lower at CHF 32.2 million, mainly due to a decrease in discretionary bonuses as a result of business performance and lower revenues. Fixed personnel costs decreased 15%, driven by lower headcount as a result of voluntary and involuntary redundancy programmes in 2020. Headcount stood at 701 FTEs as at 31 December 2020 compared with 817 FTEs at the end of 2019.

General expenses totalled CHF 75.0 million, a decrease of 25% compared with 2019. This was driven by lower consulting services, technology, travel and marketing costs.

The operating margin stood at minus 4.7%, compared with positive 4.3% in 2019. Despite having delivered cost savings in excess of our guidance, this could not fully offset the decline in AuM and revenues.

The underlying loss before taxes was CHF 14.9 million in 2020, down from a CHF 10.5 million underlying profit in 2019, driven by lower net fee and commission income and only partly offset by lower expenses, which we continued to manage tightly.

The underlying effective tax rate for 2020 was 0.0% compared with 53.3% in 2019. The effective tax rate decline was primarily driven by the underlying loss before tax.

Diluted underlying earnings per share were negative CHF 0.10, down from positive CHF 0.03 in 2019 and resulting from the underlying net loss.

The IFRS net loss was CHF 388.4 million in 2020 compared with a net loss of CHF 3.5 million in 2019, mainly driven by the impairment of legacy goodwill of CHF 373.7 million, which was primarily created by the acquisition of GAM by Julius Baer in 2005 and UBS in 1999.

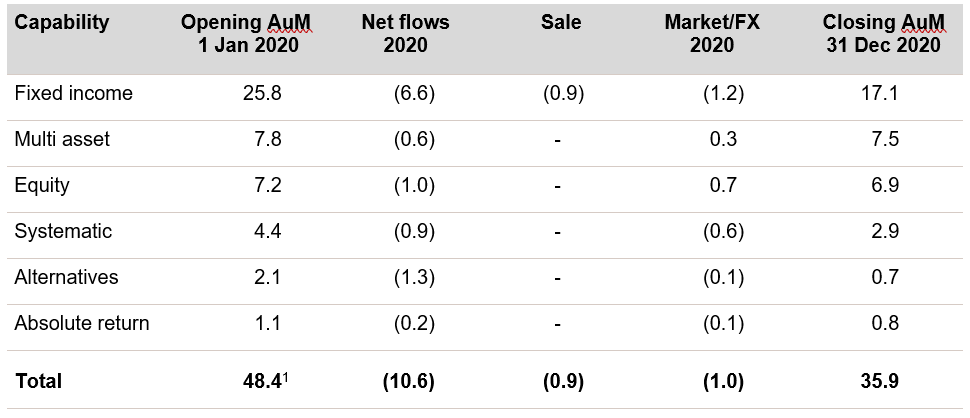

Assets under management movements (CHF bn)

AuM totalled CHF 35.9 billion as at 31 December 2020, down from CHF 48.4 billion1 at year-end 2019, primarily driven by net outflows of CHF 10.6 billion across capabilities and net negative market and foreign exchange movements of CHF 1.0 billion.

Net flows by capability

In fixed income, net outflows totalled CHF 6.6 billion, primarily driven by the GAM Star Credit Opportunities and GAM Local Emerging Bond funds, which were only slightly offset by inflows into the GAM Greensill Supply Chain Finance and GAM Star Cat Bond funds.

Multi asset strategies experienced net outflows of CHF 0.6 billion in 2020, driven by redemptions primarily from institutional and private clients.

In equity, GAM saw net outflows of CHF 1.0 billion with net inflows in the GAM Star European Equity, GAM Star Disruptive Growth and GAM Swiss Sustainable Companies funds which were more than offset by withdrawals from primarily the GAM Japan Equity and GAM Global Eclectic Equity funds.

In systematic, net outflows of CHF 0.9 billion were driven by outflows from the GAM Systematic Core Macro and GAM Systematic Alternative Risk Premia funds.

In alternatives, GAM saw net outflows of CHF 1.3 billion, driven by redemptions from institutional mandates.

The absolute return category recorded net outflows of CHF 0.2 billion, with inflows into the GAM Star Emerging Market Rates and GAM Star Alpha Technology funds being more than offset by outflows primarily from the GAM Star (Lux) – Merger Arbitrage and GAM Star (Lux) – European Alpha funds.

Investment performance

Over the three-year period to 31 December 2020, 23% of AuM in funds outperformed their respective benchmark compared with 74% as at 31 December 2019. This decrease was primarily driven by weaker performance in our two largest fixed income strategies, which were hit by market movements related to Covid-19 in March but have since rebounded. Over the five-year period to 31 December 2020, 70% of AuM in funds outperformed their respective benchmark, down from 78% as at 31 December 2019. 56% and 61% of GAM’s AuM tracked by Morningstar outperformed their peer groups over three and five-year periods as at 31 December 2020, respectively.2 Our equity strategies enjoyed strong performance in 2020, with many in the top quartile relative to their peer groups across time periods.

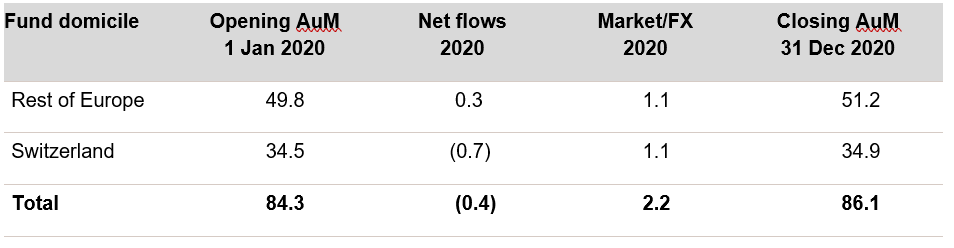

Assets under management movements (CHF bn)

Our private label funds are tailored products designed for banks, insurers, independent asset managers and institutional investors. This business is one of the largest providers of third-party management company services in Europe and delivers the fund operating platform for all our private labelling clients and approximately 78% of our investment management funds with around CHF 114 billion of combined assets under management as at 31 December 2020.

As at 31 December 2020, AuM increased to CHF 86.1 billion from CHF 84.3 billion at the end of 2019. Net outflows of CHF 0.4 billion were more than offset by net positive market and foreign exchange movements of CHF 2.2 billion.

In January 2021, a private labelling client gave notice that it will be transferring its business to another service provider as a part of a broader strategic relationship with that company. As at 31 December 2020, the client’s AuM were CHF 21.5 billion. The transition to the new provider is expected to commence in the second half of 2021.

Cash and cash equivalents at the end of 2020 amounted to CHF 270.9 million, down from CHF 315.8 million one year earlier, reflecting the net redemptions of investments in seed capital and cash flows generated from operating activities being more than offset by acquisition-related deferred consideration payments primarily related to GAM Systematic, payments associated with redundancies in connection with the restructuring programme, and expenditure capitalised relating to the SimCorp project.

Adjusted tangible equity at the end of 2020 was CHF 188.7 million, compared with CHF 197.2 million a year earlier. The main contributor to this decrease was the IFRS net loss and expenditure capitalised relating to the SimCorp project, but excluding items related to intangibles and the movement in the financial liability related to GAM Systematic.

Recognising GAM’s underlying loss in 2020, the Board of Directors proposes to shareholders that no dividend will be paid for the financial year 2020. The Board of Directors continues to target a minimum dividend pay-out of 50% of underlying net profit to shareholders.

For the financial year 2020, no bonus award will be paid to the Group Management Board, which demonstrates its accountability and further follows GAM’s key principle in linking compensation to the Group’s overall performance. In the future, long-term incentive awards will remain a part of GAM’s compensation framework as they are an integral part of the overall compensation package, aligning management with shareholders and emphasising the long-term nature of the overall compensation paid to GAM’s senior management. Any bonus awards granted under the annual discretionary bonus plan for non-GMB employees will be fully deferred over a period of three years.

At the 2020 AGM, the Board of Directors reviewed its fee structures and, in recognition of the market environment and the resulting impact on GAM decided to waive a portion of its fees. The Board has further agreed to make those changes permanent in recognition of the financially challenging environment which the firm faces.

GAM believes that it is well positioned to help clients navigate these challenging times by offering a diverse range of actively managed products and solutions through a global distribution footprint. It expects the market environment to remain volatile, but client demand to stay resilient. GAM is entirely focused on growth and further business simplification.

We recommit to our financial targets of an underlying pre-tax profit of CHF 100 million, an operating margin of 30% and a compensation ratio of between 45-50%. Due to the Covid-19 related impact on the business, the company now targets to achieve these in FY 2024.

The presentation for analysts and investors on the results of GAM Holding AG for 2020 will be webcast on 18 February 2021 at 8:30am (CET). A presentation for media will be webcast at 10:00am (CET). Materials relating to the results (presentation slides, 2020 Annual Report and press release) are available at www.gam.com.

2 The peer group comparison is based on ‘industry-standard’ Morningstar Direct Sector Classification. The share class references in Morningstar have been set to capture the oldest institutional accumulation share class for each and every fund in a given peer group.

| 21 April 2021 | Q1 2021 Interim management statement |

| 29 April 2021 | Annual General Meeting 2021s |

| 4 August 2021 | Half-year results 2021 |

| 21 October 2021 | Q3 2021 Interim management statement |

| Charles Naylor Global Head of Communications and Investor Relations T +44 20 7917 2241 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

Media Relations Kathryn Jacques T +44 20 7393 8699 |

| Investor Relations Jessica Grassi T +41 58 426 31 37 |

|

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employed 701 FTEs in 14 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano as at 31 December 2020. The investment managers are supported by an extensive global distribution network. Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange with the symbol ‘GAM’. The Group has AuM of CHF 122.0 billion (USD 138.0 billion) as at 31 December 2020.

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.