The sustainability revolution is underway. Investors are increasingly factoring in the material risks associated with environmental, social and governance (ESG) factors, and thousands of corporates have committed to ambitious targets within the coming decades.

02 August 2022

GAM Investments’ Global Head of Sustainable and Impact Investing Stephanie Maier outlines three key trends she believes will continue to drive the sustainable investment landscape over the coming years.

- Transformational policy

We expect the pace and the scale of policy interventions we have seen in relation to corporate disclosure, redirecting capital flows, sustainable finance generally and increasingly on sustainable investment products to continue to shape the landscape as we go forward.

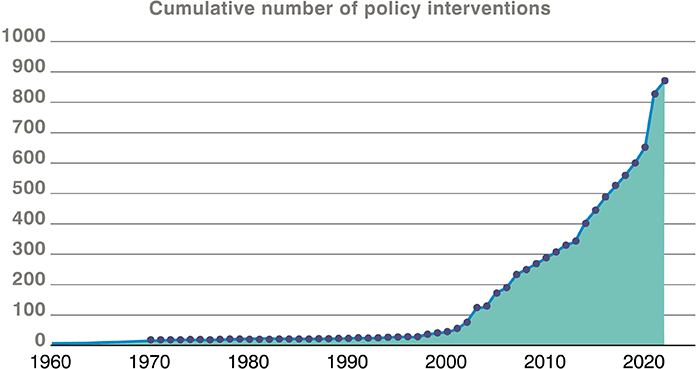

In 2021 alone, we saw more than 200 new and revised policy interventions globally (see Figure 1 below). Just some examples include the EU’s Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosures Regulation (SFDR); bringing new ESG-related reporting requirements in for corporates and investors, respectively. There is also the UK’s expected adoption of the Task Force on Climate-Related Financial Disclosures’ (TCFD) framework for large companies and the climate disclosure proposals being put forward in the US by the Securities and Exchange Commission (SEC) to address this area much more proactively.

Figure 1

A major driver of this tide of policy, in our view, is recognition that private finance is pivotal in managing and addressing key sustainability challenges. If we are going to build a net zero, sustainable economy, capital must flow at scale to those entities building that future.

In the near term, we expect to see tighter regulation on ESG data and ratings providers, as well as continued efforts to harmonise and improve corporate disclosure.

- Net zero imperative

The second trend we believe will drive sustainable investment in the long term is the net zero imperative. We know that decarbonisation is critical to ensure that we avoid the worst impacts of climate change and we are already seeing governments, as well as private finance, move towards that goal. Around a fifth of the world’s 2,000 largest companies have now committed to net zero in some form. However, the challenge of implementation cannot be underestimated, especially with financial systems becoming destabilised due to a backdrop of war and soaring inflation, exacerbating the equally important energy security and affordability challenges.

In order to reach crucial climate goals, clean energy investment needs to triple to around USD 4 trillion by 2030, according to the IEA. Initiatives such as Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of financial institutions worth USD 130 trillion in assets, are already starting to pivot to investing for the net zero transition. Nevertheless, we will need to see more collaboration among investors to mobilise large scale finance, and investors will need to be accountable for meeting agreed targets.

Companies are increasingly called upon to demonstrate robust climate transition plans that support a low carbon future. The AGM season has so far seen more than 30 management-backed “Say on Climate” votes – already more than last year. Investors like ourselves have a duty to scrutinise those plans and to use our voices at shareholder meetings if they are not comprehensive enough. In the UK, following an announcement during COP26, the Treasury launched the UK Transition Plan Taskforce with the aim of developing a gold standard for climate transition plans. Developing a common understanding of what an appropriate transition plan looks like will be a key focus, particularly over the next two years.

- Transparency to accountability shift

The third trend we expect to drive the sustainable investment landscape over the long term is the more general shift from focusing on transparency to demonstrating accountability. This applies to both the finance sector and to corporates as a broad range of stakeholders – consumer bases, employees, regulators and society more broadly – are increasingly looking to companies to address their social and environmental impacts in a more focused and detailed way.

As just one example, more than 13,000 companies worth approximately 64% of global market capitalisation, disclosed data through CDP on climate change, water security and deforestation in 2021. This marked an increase of 37% since 2020. As positive as it is to see this significant increase in disclosure, the next step is for companies to show greater accountability. For example, while most companies report on how issues like climate affect their business, new rules are likely to require them to also report their impacts, ie how their business is impacting the climate. In EU terminology, this marks the shift from single ‘materiality’ focused on the risks to the company to a ‘double materiality’ perspective, which requires companies to disclose not just how sustainability issues are affecting their business but crucially how their business is impacting the environment and society.

Clearly then, the sustainable revolution is underway, but as each of these trends highlights, the transition to a more sustainable world will be far from straightforward. It is imperative that we collaborate and collectively embrace this period of transformation, but that we are equally clear-eyed about the challenges we face ahead.

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is not a reliable indicator of future results or current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented and are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. There is no guarantee that forecasts will be realised.