Multi-Asset – A focus on super-secular trends has arguably never been more necessary

December 2023

Challenges and opportunities: Click here to read GAM's investment managers' Outlooks for 2024.

As 2023 draws to a close, it would be safe to conclude that it has been the second year in a row in which the investment landscape was dominated by the future trajectory of inflation and interest rates. 2024 seems hardly likely to be spared from the same focus. Yes, US inflation has been coming down but it has been relatively slow to do so and core inflation remains stubborn at 4%. As such, the US Federal Reserve (Fed) will remain on alert amid the feeling that its job is not quite done yet. Furthermore, the apparent impotency of the Fed’s primary weapon, the discount rate, may make the US central bank more hawkish than investors expect. Even as interest rates have ratcheted up (5.5% at the time of writing), the US labour market remains tight, with unemployment standing at just 3.7% and nominal wages still growing at over 4% per year. Recession in such conditions is therefore far from obvious, even though the housing market has stalled and credit card delinquencies are on the rise.

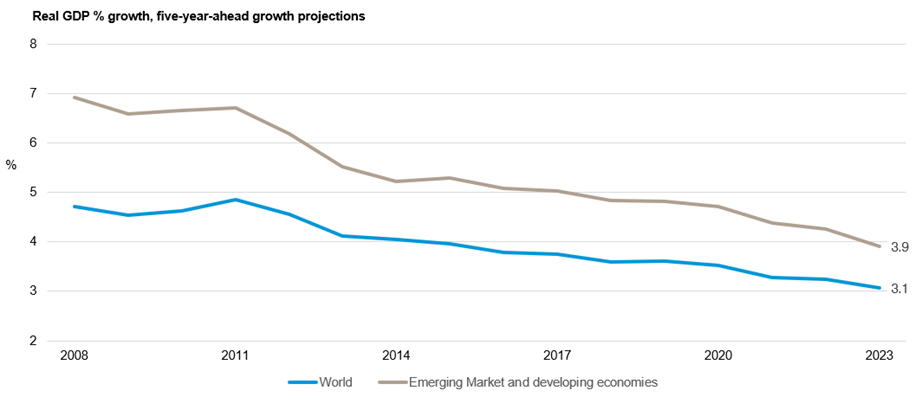

Beyond the US, China’s economy is posting slightly less disappointing figures which could be sustained if the monetary authorities can continue to pull off the balancing act of cooling the real estate market without crashing the wider economy. Encouraging as this may be, none of it really changes the longer-term calculus for the world economy, namely secular stagnation. As the International Monetary Fund (IMF) noted at its recent World Economic Outlook, global GDP growth in the five years before the pandemic averaged nearly 4% but over the next five years now looks set to average just 3% (see chart). Persistent inequality, shrinking workforces, demographic challenges, trade protectionism and climate change all look set to weigh heavily on growth even if the US somehow escapes recession and China manages to muddle through.

Secular stagnation remains the world’s long-term growth fate:

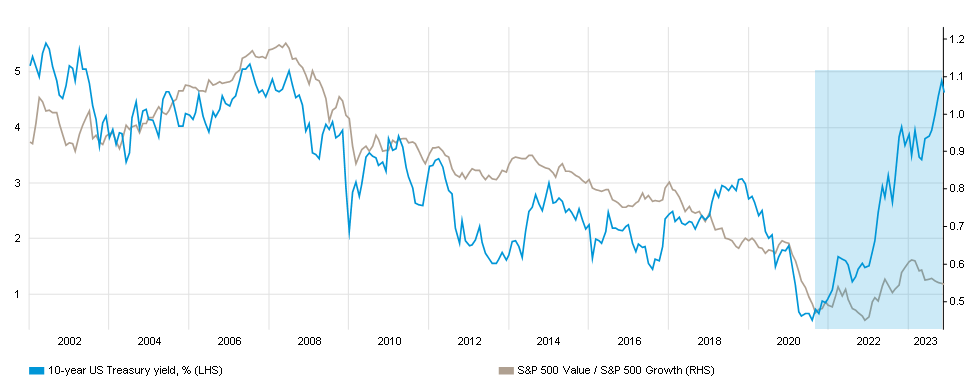

Amid such a bleak growth context, the good news is that inflation, and subsequently interest rates, should eventually settle down from current levels. Which bring us to markets. In the US – which dominates global equity indices – stocks currently pay very little more in terms of (earnings) yield than government bonds. For this to change, there has to be one or more of an equity price correction, a jump in corporate earnings, or a meaningful decline in bond yields. None of these are impossible in themselves, but a market correction and/or bond yields slowly falling as inflation and growth prospects ease seem more likely than a boost in corporate earnings. At that point, US equities at least should start to become relatively more attractive than bonds and emerging market equities would also benefit from the associated weaker US dollar given how global trade is mostly invoiced in dollars. But these pathways are by no means certain. Markets could simply stay stretched as speculation around artificial intelligence (AI) continues to support technology stocks. Indeed, one of the more striking features of 2023 has been the sector’s continued strong performance in the face of higher rates, which accounting logic dictates should induce a sell-off in such high revenue flow stocks (see chart).

US Growth stocks (read Tech), driven by AI, have outperformed even as yields have risen:

Similarly, bond yields could take some time to fall. It is important to note that the rise in yields seen in the second half of 2023 was in significant part attributable to the so-called ‘term premium’ which measures the riskiness investors see in government bonds. Amid rising geopolitical tensions, extended budget deficits and hopelessly divided US politics, a lower inflation and growth trajectory may take a little longer to make itself felt in the bond markets in 2024. Given this uncertain picture, professional investment management focused on super-secular trends has arguably never been more necessary. Well-established narratives such as the ability of stocks to outperform bonds, real estate and cash over time, as well as the additional opportunity they afford to capture the gains from US technological innovation and the ascendancy of China and emerging markets remain undimmed given a long enough horizon. But near-term volatility in the coming months may well unnerve investors, inducing unforced errors which divert them from the optimal pathway to their financial goals. This is where carefully structured equity strategies, with complementary capital preservation assets that can smooth out episodes of volatility, come in. By happy coincidence one of the main headwinds to equities in the near term – high risk-free short-term yields – also offer superb risk-reward characteristics ideally suited to offsetting volatility in stocks. Such pragmatism, along with an active focus on transparency and simplicity in portfolios, will be essential as the challenges outlined play out in the coming months.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio nor represent any recommendations by the portfolio managers nor a guarantee that objectives will be realized.

This material contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.