Gregoire Mivelaz, Fund Manager, Atlanticomnium, discusses the current state of fixed income markets, European financials and his outlook for subordinated debt.

20 December 2023

Despite the challenges over the course of 2023, we think the macro backdrop looks bright and sets up a great runway for the coming year for subordinated debt.

Macro backdrop - Tailwind for credit

Past performance is not an indicator of future performance and current or future trends.

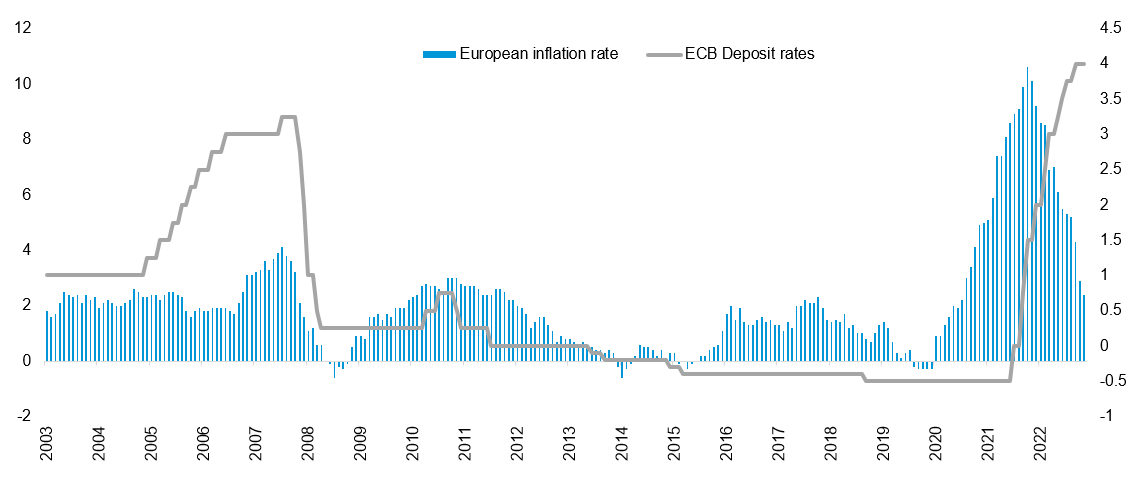

While the European Central Bank (ECB) has raised rates to unprecedented levels, inflation in Europe already came significantly down this year, opening the door for the ECB to cut rates in 2024, as is typical in such a highly cyclical environment. In our view this macro backdrop creates a tailwind for credit, which would be beneficial for subordinated debt.

The last hike – A great entry point of credit

Past performance is not an indicator of future performance and current or future trends.

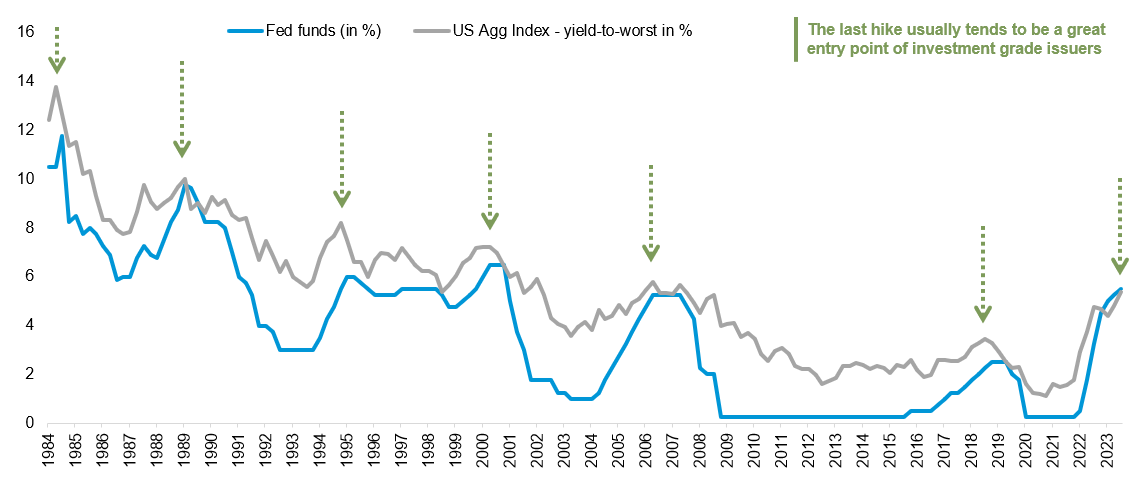

We think the last rate hike is a good entry point for credit. The blue line in the chart above represents the Federal Reserve (Fed) fund rate in the US and the grey line represents the Bloomberg US Aggregate Credit Yield To Worst Index (LUCRYW:IND). Over the past 30 years, if you bought credits on the day the Fed stopped hiking rates, you made money as you not only benefited from the relatively high carry due to the elevated rates but also benefited from price appreciation as rates gradually normalised.

A Year of surprises

Our projections for 2023, anticipating carry and price appreciation, were met with unexpected turns due to unique circumstances that escalated volatility to unprecedented levels. The initial forecast of central bank rate cuts due to slowed growth in developed economies was disrupted by the US banking crisis. This crisis prompted extraordinary measures by the Fed, coupled with robust fiscal support that propelled the US economy, necessitating further Fed rate hikes.

2023 proved an extraordinary period for financial institutions, witnessing the failure of 5 US banks and the acquisition of Credit Suisse by UBS. However, amidst the chaos, the sector exhibited predictability. Fundamental improvements persisted due to rising rates, with EU / UK banks honouring their callable perpetuals despite market expectations. Notably, global investors steadily re-engaged, notably evidenced in the buoyant primary market for Additional Tier 1 (AT1) Contingent Convertibles (CoCos).

November showcased a return to normality (or exuberance)

November signalled a return, or perhaps a resurgence, of normalcy. EU / UK banks issued approximately USD 10 billion of AT1 CoCos, triggering an unprecedented demand of around USD 80 billion on the primary market, nearly 40% of the market size. UBS's issuance of USD 3.5 billion of AT1 CoCos witnessed a staggering demand of USD 36 billion, an all-time high for the AT1 CoCo market. This robust demand, even in the Swiss market, underscores the vitality of AT1 CoCos, dispelling assumptions of its demise.

Despite the ongoing normalisation and evident on-going improvements in the fundamentals of EU / UK banks, spreads persist at highly attractive levels. Moreover, extension risk remains mispriced (half of the market still priced to maturity), despite all national champions having called this year and a historical call rate of 93%. Both elements should help to further drive the potential for price appreciation.

Subordinated debt: A sweet spot in a strong banking sector

European and UK banks' robust fundamentals and the uptick in interest rates have notably bolstered their equity prices by almost 20% this year. However, we do not believe subordinated debt, particularly AT1 CoCos, have fully benefited from this positive momentum. Presently yielding approximately 10%, this disjunction between fundamentals and valuation offers a compelling opportunity for bondholders. We foresee subordinated debt poised in a favourable position, promising consistent income and potential price appreciation as we step into 2024.

What could go wrong?

While we expect 2024 to trend towards normalisation, pockets of volatility may arise as markets grapple with the soft-landing narrative. To navigate potential uncertainties, favouring high-quality or investment-grade issuers, inherently more defensive due to robust credit metrics, is advisable. Moreover, with significant global elections scheduled in 2024, headline risks and intermittent volatility might unveil intriguing investment prospects for bondholders.

The past few years have posed challenges for subordinated debt despite its high carry. Thus, the greatest surprise for 2024 might indeed be a return to normalcy, so we are ready to take-off.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Past results are not necessarily indicative of future results. Investors could lose some or all of their investments.

The foregoing views contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.